We did a survey of our ~150 investors at Front Porch late this fall.

Although we are (still) flattered that 97% would recommend us to their network, an area of opportunity was getting everyone together to share market trends and data more regularly. With that in mind, we hosted an LP-only session last week to share a market update on venture in the Southeast. It was jammed with content and we were talking fast and as a result it may be one of the few things that is indecipherable at 1.25x speed (separately, on other recent indecipherable things, yes: Kendrick Lamar was awesome, but I do think his mic could have been turned up a bit).

As a hybrid fund, we sit on a unique perch in the ecosystem, with insight into fund partners, our fund network, and our direct startup investments. As more new and better industry data continues to hit the market, we have a ton of ways to benchmark ourselves and help clear the typical opacity of the first ~5-7 years of a venture fund.

A few headlines that we can share publicly and seem worth sharing:

(Preamble) Valuation policies. Benchmarks are irrelevant if valuations are non-standard and/or inconsistent. We spend a lot of time on a fund’s valuation policy during diligence so that we can calibrate their historical results and put their regular updates to us in the context of their policy. In general, our fund partners have conservative valuation policies. Our own books are marked conservatively as well, only adjusting UP for new priced rounds, but marking DOWN when we have info that indicates an asset is impaired. Given this, we track and share (but don’t mark) non-priced (SAFE/note) valuation changes led by other investors as well as revenue trends to add more color to company performance on the direct investment side of our portfolio. We were excited to share the momentum here.

Vintage benchmarks and performance. Post-investment period benchmarks for 2019/2020/2021 funds are starting to come into better focus for DPI, TVPI, and IRR (from least-to-most gameable). StepStone says ~50% of funds who are top-quartile at Year 5 end up being top-quartile at Year 10. We are excited to have a significant share of our fund partners already trending in that direction. On DPI, an interesting but not entirely unexpected correlation: Fund partners with a relatively high fund count (i.e., Fund 4 compared to our average of Fund 2.6) are more likely to have early DPI. As has been discussed in various forums, all DPI is not created equal, and we do spend a lot of time trying to understand the factors that lead to an early distribution, which are often strategic and not always good.

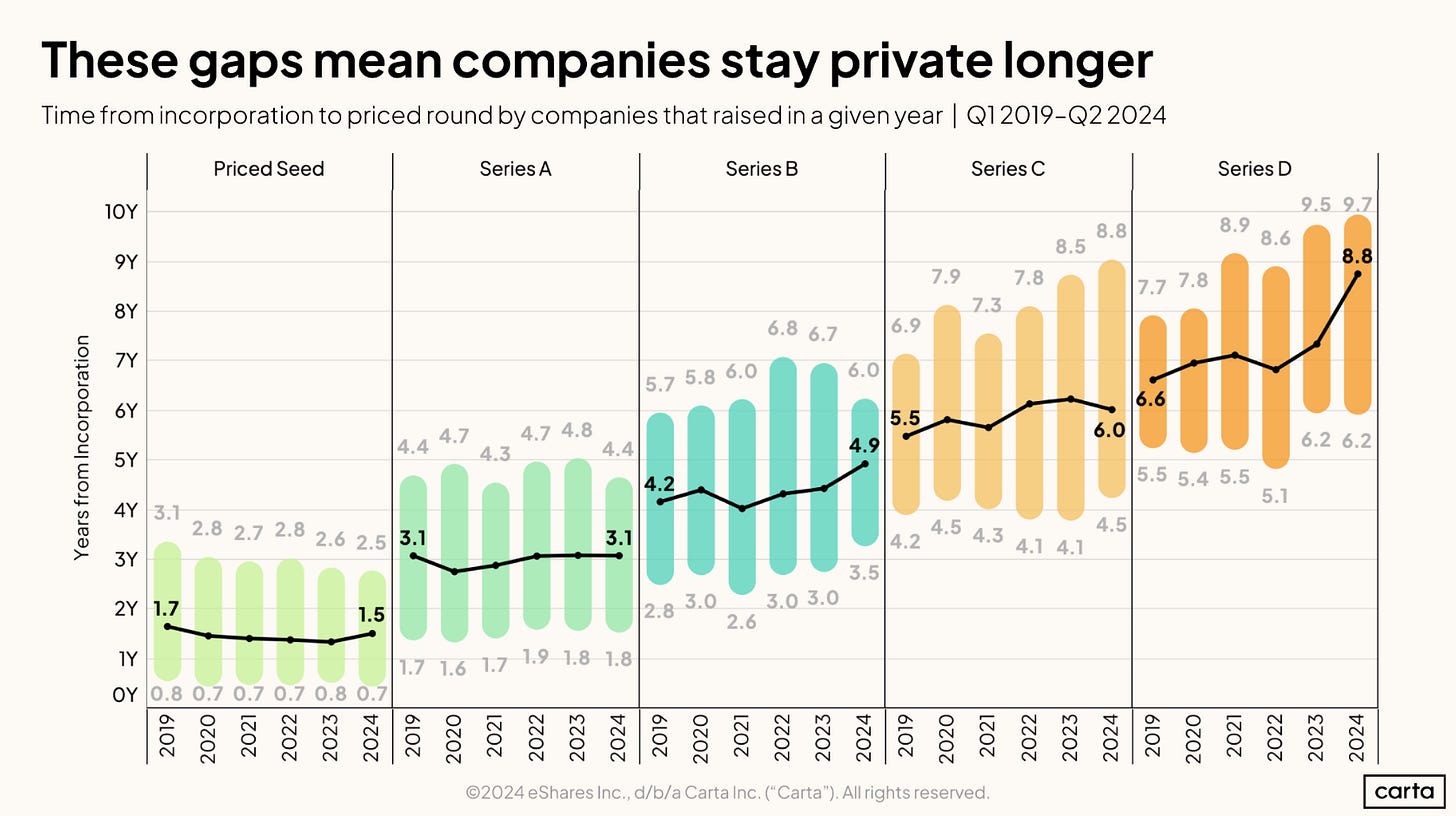

Securing the next round of funding. A chart from Carta that warranted a lot of discussion after the session is below, together with a discussion on graduation rates declining. tldr; Time between rounds continues to increase and graduation rates are declining, especially at the late stage. Is that moderating as we hit 2025? We swung hard into extending runway, but where exactly are we right now on the balancing act of growth and runway? Given the best potential future funding rounds require strong growth, how are funds (and Front Porch) advising their founding teams on where to fly on the growth/runway spectrum?

Questions like these are some of the best questions in venture right now related to existing portfolios. A whole generation of founders spent years getting “default alive,” but growth has slowed as a result, and the next move is complicated.

We see our best-positioned fund partners and founders advising/doing a few things, and we are advising/doing them, too: 1) get extreme precision on your next growth lever, and make it product-led growth if you can; 2) metrics become ticket-to-entry at Series A/B, so make sure that you are in-tune with the market, know where you need to be across non-revenue KPIs, and start calibrating them with friendlies ASAP; and 3) get your existing cap table engaged, because new money might fund an acceleration from moderate growth, but not from low/no growth, and is more likely to be punitive.

The best setups that we see right now feature a startup that is default alive, but has retained at least moderate revenue growth, clear evidence of how new capital can get turned into high growth, and an existing cap table that is well reserved. The toughest setups right now are low/no growth with an existing cap table that is tapped.

The spectrum is clearly shifting back to growth (not much choice!) at the expense of runway, and we’ve started the year with our eyes on data (first/third-party) that can give us a sense of whether founders and funders are managing to thread this needle successfully — giving us another indication of which funds are trending top quartile.

THANK YOU to a few people whose industry data and perspectives were super useful to us — namely, Peter Walker at Carta (fund investment benchmarks);

at (performance of small/emerging managers); and James Heath at dara5 (share of generalist versus specialist funds who are top versus bottom quartile).Interested to hear more? Let us know, happy to chat anytime.